send link to app

Simple Tax app for iPhone and iPad

4.2 (

2592 ratings )

Finance

Developer: HollerSoft

0.99 USD

Current version: 1.1, last update: 7 years agoFirst release : 22 May 2013

App size: 608 Kb

Calculate taxes for any number of categories of goods & services, to make invoicing easier. Just enter the amounts and all taxes and total are calculated for you.

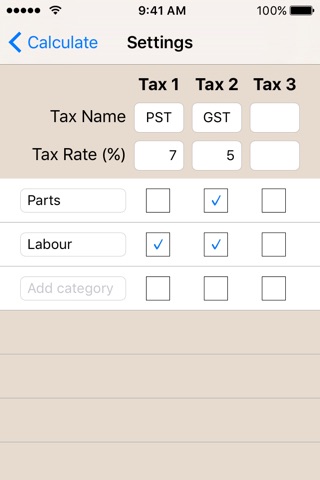

The app supports up to three different taxes, and any number of categories of goods & services. The taxes to apply to each category are completely configurable.

For example, suppose Parts are subject to a 7% PST (Provincial Sales Tax) and a 5% GST (Goods & Services Tax), but Labour is subject to the GST only. This is the default configuration. Once configured, you simply enter the amounts for Parts and Labour and the taxes are calculated for you.